Safeguard Your Child's Future: Discover to Save for College Wisely

Wiki Article

Achieving Financial Success in College: Practical Preparation Tips for Students

Browsing the financial difficulties of university can be a difficult task for pupils. As tuition costs remain to increase and living expenditures build up, it is crucial for pupils to develop useful planning approaches to accomplish economic success throughout their university years. From establishing financial goals to taking care of student car loans, there are countless actions that pupils can take to ensure they are on the best track towards a steady financial future. In this discussion, we will explore some practical planning suggestions that can aid trainees make notified choices regarding their financial resources, inevitably permitting them to concentrate on their scholastic quests stress-free. So, whether you're a fresher simply beginning your university journey or a senior preparing to get in the labor force, keep reading to uncover beneficial insights that can lead the way to monetary success in university and beyond.Setup Financial Goals

When establishing economic objectives, it is vital to be practical and details. As opposed to merely aiming to save money, set a specific quantity that you want to save each month or term. This will certainly offer you a clear target to function towards and make it simpler to track your progress. Additionally, make sure your goals are reasonable and achievable within your current economic circumstance. Establishing unrealistic goals can result in frustration and prevent you from continuing to work towards financial success.

Moreover, it is important to prioritize your economic objectives. Establish what is most important to you and focus on those objectives initially. Whether it is settling pupil finances, saving for future expenditures, or developing a reserve, understanding your concerns will aid you designate your resources effectively.

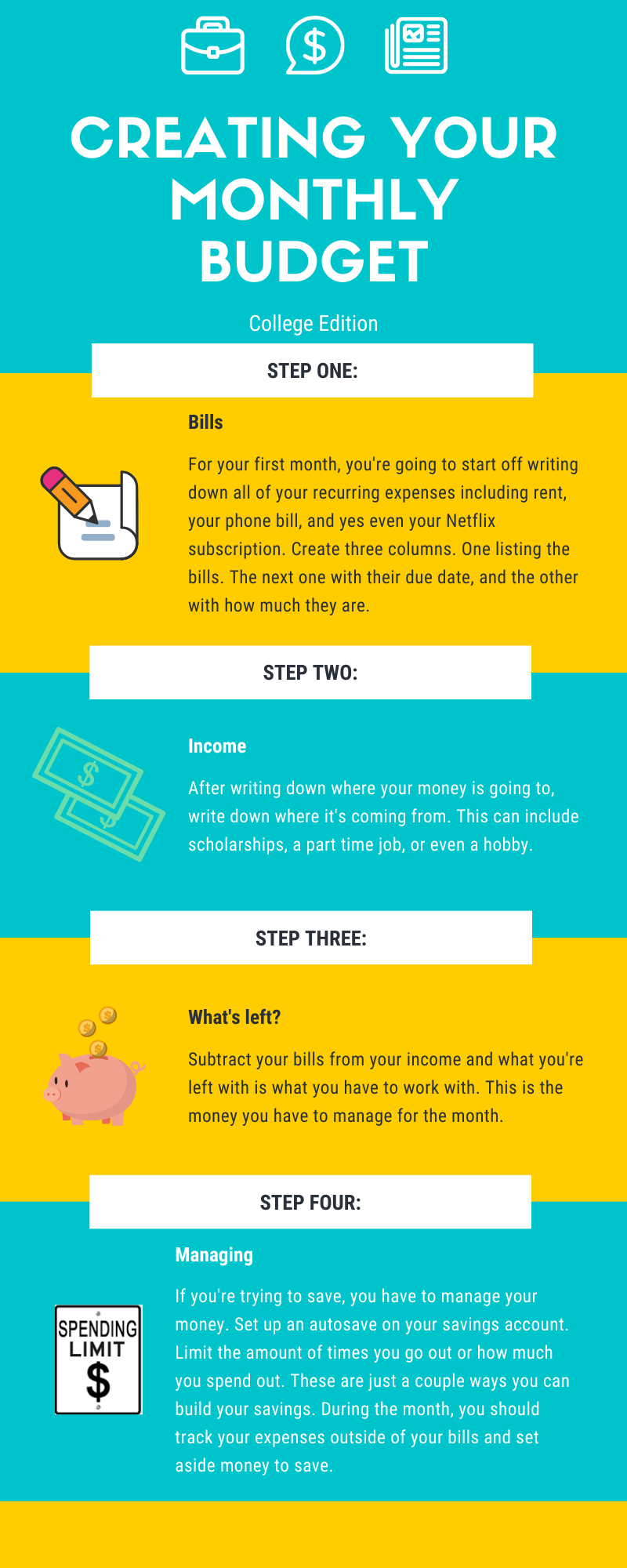

Creating a Budget

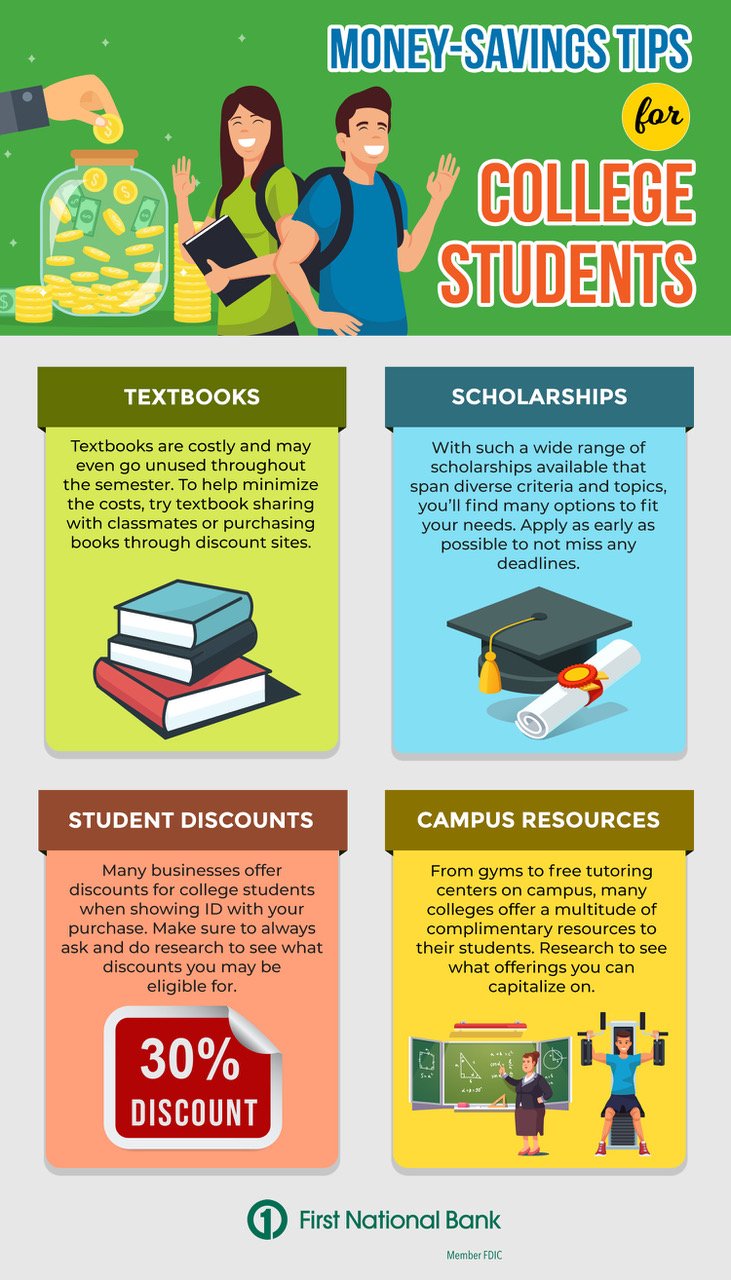

When developing a budget plan, start by establishing your income sources. This can consist of money from a part-time task, scholarships, or monetary help. Next off, list all your expenses, such as tuition charges, textbooks, rent, energies, transportation, and dishes. When estimating your costs., it is important to be sensible and detailed.

Once you have actually recognized your revenue and expenditures, you can designate your funds appropriately. Consider reserving a portion of your income for emergencies and cost savings. This will assist you build a safety and security internet for unexpected costs and future goals.

Evaluation your budget consistently and make modifications as needed. This will ensure that your budget plan remains efficient and realistic. Tracking your costs and contrasting them to your budget will certainly assist you identify locations where you can reduce or make enhancements.

Developing a budget is a vital device for economic success in college. It enables you to take control of your funds, make informed choices, and work towards your monetary objectives.

Optimizing Scholarships and Grants

Maximizing gives and scholarships can significantly ease the economic burden of college costs. Scholarships and gives are forms of financial assistance that do not require to be paid off, making them an optimal way for students to fund their education. Nevertheless, with the climbing cost of tuition and fees, it is important for trainees to optimize their possibilities for scholarships and grants.One way to optimize scholarships and grants is to begin the search early. Several companies and establishments supply scholarships and grants to students, yet the application target dates can be months in advance. By beginning early, students can use and look into Your Domain Name for as lots of chances as possible.

Furthermore, students should extensively review the eligibility requirements for every scholarship and grant. Some might have certain standards, such as academic success, area participation, or certain majors. By comprehending the needs, pupils can tailor their applications to highlight their strengths and raise their possibilities of getting financing.

In addition, trainees should consider using for both nationwide and regional scholarships and gives. By diversifying their applications, trainees can optimize their chances of safeguarding monetary aid.

Handling Pupil Fundings

One essential facet of navigating the economic responsibilities of university is properly handling trainee car loans. With the climbing cost of tuition and living costs, several students count on financings to fund their education and learning. Nonetheless, mismanaging these fundings can bring about lasting monetary concerns. To prevent this, trainees need to take several steps to properly manage their trainee financings.Most importantly, it is essential to comprehend the conditions of the financing. This consists of recognizing the rate of interest, settlement duration, and any type of prospective charges or fines. By recognizing these details, students can plan their financial resources as necessary and prevent any type of surprises in the future.

Creating a spending plan is another vital step in managing pupil financings. By tracking earnings and expenditures, pupils can make certain that they designate enough funds in the direction of financing settlement. This additionally assists in determining locations where costs can be decreased, permitting for even more money to be routed in the direction of car loan settlement.

Furthermore, pupils must explore choices for car loan mercy or payment help programs. These programs can offer alleviation for hop over to these guys debtors that are having a hard time to repay their car loans. It is vital to research study and comprehend the eligibility requirements and web link requirements of these programs to make the most of them.

Finally, it is essential to make prompt funding payments. Missing out on or postponing payments can bring about additional charges, penalties, and unfavorable influence on credit rating. Establishing up automated repayments or suggestions can help make sure that settlements are made on schedule.

Conserving and Investing Approaches

Navigating the monetary duties of university, including efficiently taking care of student fundings, establishes the structure for students to execute saving and investing approaches for long-term financial success.Saving and investing techniques are essential for college trainees to protect their monetary future. While it might appear daunting to start investing and saving while still in college, it is never ever too early to begin. By implementing these techniques at an early stage, pupils can capitalize on the power of compound interest and build a solid financial foundation.

Among the initial steps in conserving and spending is creating a budget. This allows students to track their revenue and costs, determine areas where they can cut down, and allocate funds in the direction of investments and cost savings. It is vital to establish certain monetary goals and create a strategy to attain them.

One more method is to develop an emergency situation fund. This fund works as a safety and security web for unanticipated expenditures or emergency situations, such as clinical bills or automobile repair services. By having an emergency situation fund, trainees can prevent going into financial debt and keep their economic security.

Verdict

Finally, by setting monetary goals, creating a budget, maximizing grants and scholarships, handling student financings, and executing conserving and investing strategies, university student can achieve monetary success during their academic years - Save for College. Embracing these useful planning suggestions will certainly assist pupils develop responsible economic routines and make certain a more safe futureAs tuition expenses continue to increase and living expenditures include up, it is essential for trainees to establish sensible planning techniques to accomplish monetary success throughout their university years. From establishing economic objectives to managing student car loans, there are many actions that students can take to guarantee they are on the appropriate track in the direction of a secure economic future.One critical facet of navigating the financial duties of university is properly taking care of trainee finances. To avoid this, pupils should take several actions to properly handle their pupil financings.

Conserving and spending methods are vital for college students to protect their monetary future.

Report this wiki page